Welcome to Rule Breaker Edition #12

Today’s focus is:

Understanding how venture capital works and questioning if there is a better way to fund our future.

I make the complex understandable - and sprinkle in how to make our world more inclusive. To join the crew who receives this in their inbox, click that pretty pink button.

Opening Spiel

Venture capital markets are hot 🌶 . Record amounts of money are flowing into VC funds and then to entrepreneurs.

Many cheer. This private investment fuels the evolution of our economy. It creates more jobs, more solutions to our worldly ills, and more wealth.

There is another way to look at this system, though. One that isn’t as sexy and poses some questions on if there is a better way to fund our future.

And that’s what I’m here for :)

TL;DR in 3 Images

I’m trying something new based on helpful input I’ve received.

First - I’m gonna show a fuller picture of the system and the many pieces that need to change (i.e., the rules that we need to break for a sustainable shift in the status quo 😎).

Second - I’m gonna sum up the article quickly. This helps with inbox overload and easing us into the longer version.

(I’d love to hear if you like it - and especially what you’d change! Reply back to this email or message me on LinkedIn or Twitter)

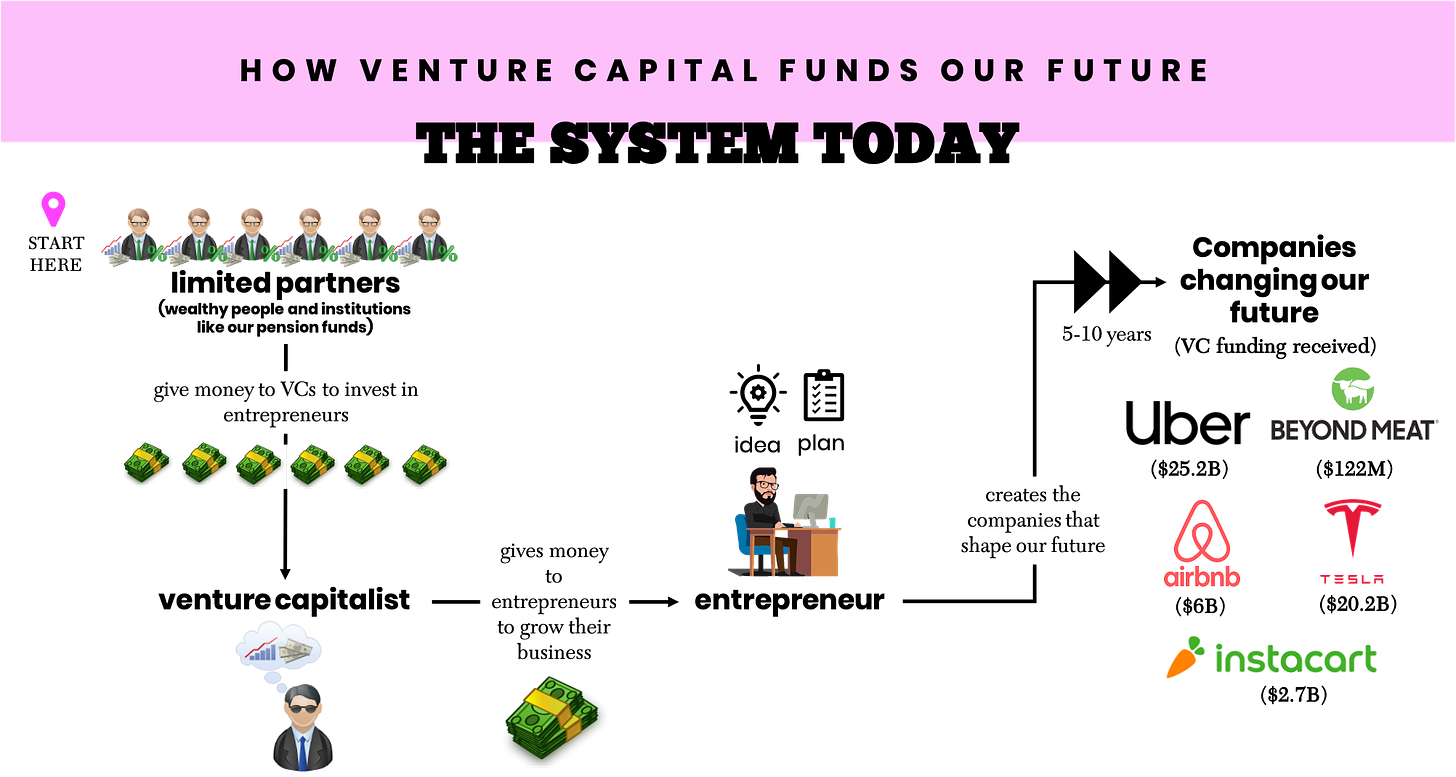

Image 1.

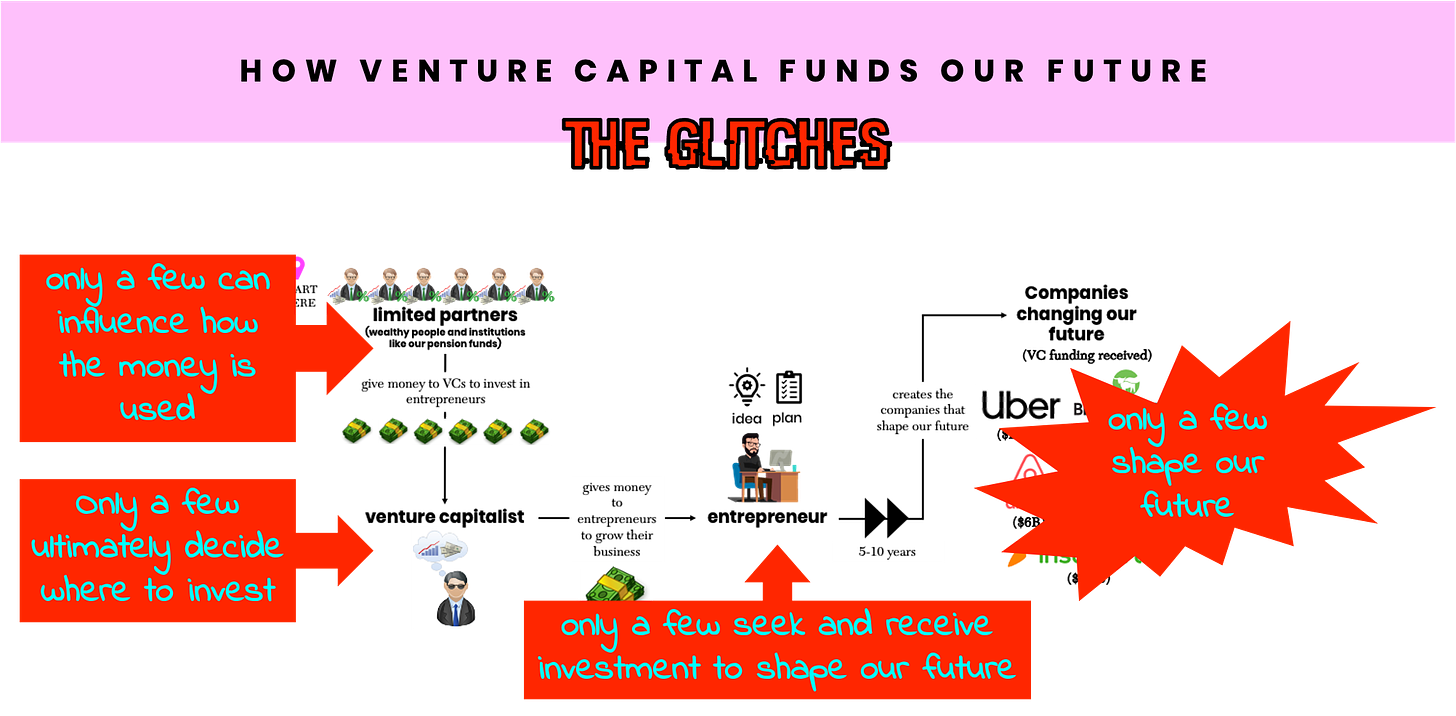

Image 2.

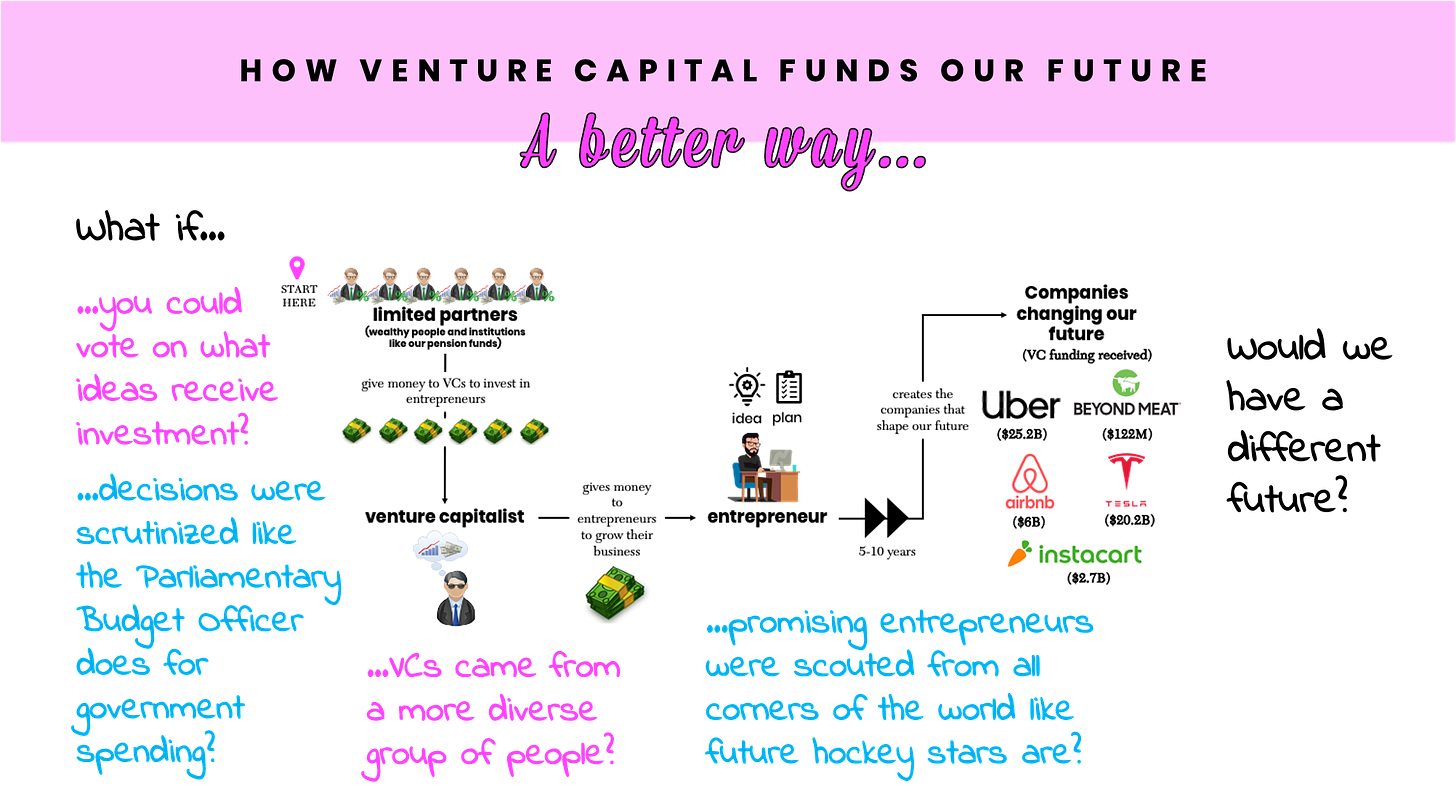

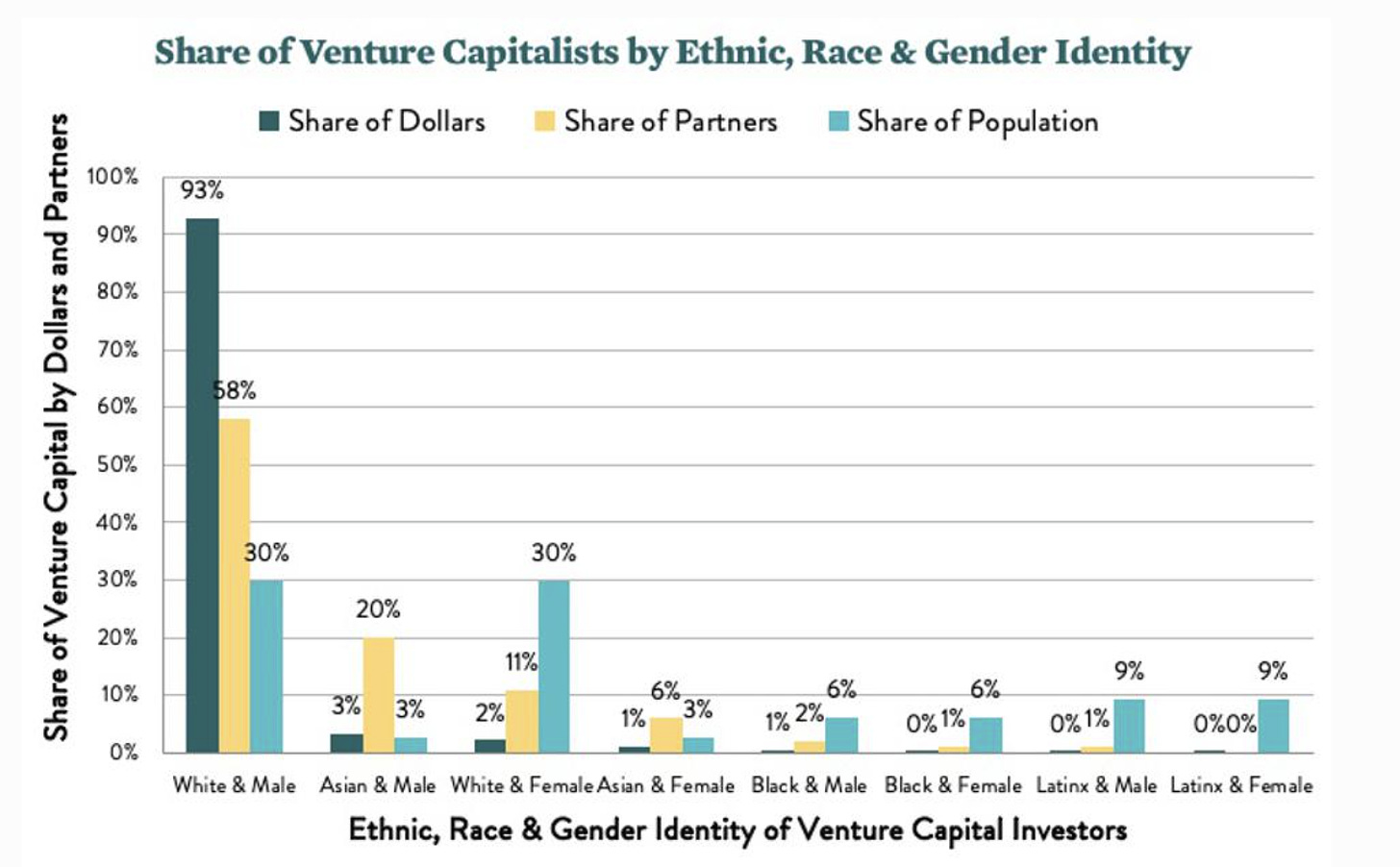

Image 3.

Wanna go deeper on this? Let’s dive in.

A Primer on Venture Capital

First, let’s ground ourselves in how venture capital works.

A VC will go out and collect millions - or in some cases billions - of dollars (they call this a fund).

They’ll do this by going to wealthy individuals or institutions (like our pension funds) and saying “Hey. Wanna give me 5% of your wealth? I’ll invest it in small companies that have the potential to grow super big. This will get you better returns than the stock market.”

That wealthy person or institution is called a Limited Partner (LP for short) and if they decide it’s worth the risk, they’ll give the VC money.

Next, the VC will chat with entrepreneurs to find the ones that have the best idea or plan for making an awesome business.

If the VC thinks the entrepreneur is onto something then they will invest because they expect the company to be worth a lot more in the future.

The entrepreneur is excited to talk with the VCs. They have a big vision for their company but need money to pay for employees, marketing and the like to get going (and the bank won’t lend them money because they don’t have any assets, like a factory or revenue.)

Once the deal is done, the work begins and hopefully in 5 or 10 years, the company is worth a lot more and is achieving its super big vision of changing our world.

The key thing to take away here is:

This set of transactions are all private. Even if the LP is a public institution, once they give money to a VC, you as a citizen or shareholder don’t know where it goes.

The investments define our future. NBD. A VC investing in an entrepreneur today is essentially placing their vote for the business that we will have in the future. Those businesses will be things that we rely on for goods and services (think: AirBnB, Uber, Facebook, Amazon).

Venture Capital is Hot Right Now

So this VC thing is kinda big.

Globally, $125B was invested in companies in the first three months (aka Q1) of 2021 alone. This is 94% more than was invested the same time last year.

$69B was invested in US companies in Q1 2021.

$2.7B was invested in Canadian companies (the highest ever on record) in Q1 2021.

For comparison, the amount given to build a better future for developing countries (known as official development assistance) was $161B for all of 2020. That means entrepreneurial ventures will receive more funding in the first four or five months of this year than the 140 developing countries around the world received in all of last year.

If you want to compare the $2.7B in Q1 for Canadian companies, we can look at what the federal government invests in our future economy. In the 2021 federal budget, $720 million a year is proposed for small businesses and entrepreneurs. That’s less than 10% of what is invested in the private markets.

So yeah, every dollar invested in VC is a pretty important vote for our collective future.

VC Decisions Have Left Some Out

K - so we know VC is private and impactful on the future we will have. Now the question is where has this money gone?

Let’s look at the top 10 Canadian investments from Q1 this year:

Fraction Technologies ($289 million) - financial services to access home equity

Hopper ($215 million) - travel deals

Top Hat ($163 million) - education tech

iLobby ($127 million) - keeping track of the visitors to an office building

Clearbanc ($126 million) - loans for e-commerce businesses

Svante ($125 million) - carbon capture done cheaply

Snap Commerce ($108 million) - enabling people to buy things with their phones

Notch Therapeutics ($108 million) - cell-based therapies, starting with cancer

Koho Financial ($70 million) - a non-bank for spending and saving

Corvista Health ($65 million) - cardiac diagnostic platform

For these specific investments, this is how capital was allocated:

12% went to making us healthier

9% went to clean up the environment

42% went to making it easier and better to do money-related things (like taking out loans, purchasing and saving)

The rest went to education, travel and tracking who enters an office

Here’s a question for you:

If you had $100 million, how would you allocate the dollars shaping our future?

Personally, I’d put more towards the UN Sustainable Development Goals - you know, the things we as a whole world agreed is important. But that’s just me.

Why the VC system benefits some at the exclusion of others

So now the big question - why does this system invest in a narrow set of solutions for our world?

Scott Galloway in his newest book Post Corona drew out the most direct way to answer this: white men control 93% of the venture capital dollars. As you can see in the chart below, that is not representative of the population.

As a result, the majority of the investments go to white males too. Less than 1% of the $150B invested in US went to Black founders. Only 2% of global funding goes to women-led startups. The same abysmal stats exist for Indigenous, Latinx and other minorities.

This data just looks at the issue from a gender and ethnicity angle. My hunch is that if we looked at the data from a socio-economic, education, or life stage angle we’d see that there are many segments of our population that aren’t given money to build our future.

Only a small segment of the population receiving venture capital funding.

This matters because entrepreneurs solve problems that they see and experience.

So, if only one segment of the population is getting money, then only one segment of our issues are being solved.

Let’s look at a very specific example of hair care products. If it’s mainly white men giving money to mainly white male VCs who then invest in mainly white guys - then the chances of them making hair care products for Black women is slim.

And that’s a major reason why there are so few hair care products for coily hair (defined as types 4A, 4B and 4C). Black women, who have this kind of hair, aren’t likely to be VCs, nor funding VCs, nor pitching VCs, nor receive funding if they do pitch.

A starting list of how to make this better

There has to be a better way - and the good news there is early momentum. And - there has to be waaaaaaaaay more.

Here is a starting list with a promise that I’m going to go further on the solutions in future posts.

So, what if…

…you could vote on what ideas receive investment? This would be a direct way for you and I to rally for change when normally it’s really hard for us to have a collective voice.

…decisions were scrutinized like the Parliamentary Budget Officer does for government spending? This way there would be transparency on how things are spent and easier for folks like you and me to speak out.

…VCs came from a more diverse group of people? This is where a lot of the industry is focused right now AND there is still a lot of work left to do given the numbers above.

…promising entrepreneurs were scouted from all corners of the world like future hockey stars are? Entrepreneurs don’t just rise up out of nowhere - they need nurturing from a young age and that nurturing could be better distributed across the population.

Would we have a different future? I think so.

I’ll get more into the solutions in an interview with Paul Cambell, an investor for True Ventures, a mega VC firm trying to make it so that “all founders get equal access to capital and opportunity.”

Parting words

I’ve raised and benefitted from venture capital. Right now, it’s the best system we have and it is taking active steps to improve the way money is allocated to address underserved markets.

As we evolve, I think it begs the question of whether there is a better way to make sure that the decisions made on our future truly serve the needs of our society.

Something I’m noodling and thought I’d reveal the matrix to y’all as well.

My thanks to Paul and Assaf for inspiration and input on this post. 🙏💕

If you made it here - can you do one of the following as a favour?

➡️

Jess